The Flexiblefxtrade ECN offers cutting edge and high performance technology while leveraging our ten years of trading relationships to give you direct and anonymous access to a truly unique and diversified mix of liquidity.

For the first time ever you’ll have access to the same level of transparency as institutional traders, including; which bank filled your trade, the slippage, speed, order book and tick charts showing market impact. Oh yeah, and we provide detailed trade receipts for all of your trades.

The Flexiblefxtrade ECN account is for traders who demand absolute performance from their broker.

Extensive and diverse liquidity mix comprising 3 Crypto brokers, 20+ tier-1 bank, non-bank market makers ensure our spreads rank among the top brokers globally across the products that we offer.

We hold our trading counterparties to a high standard. By maintaining fill ratios with our LPs of greater than 90% and using ‘no last look’ when supported, we execute your trades in record fast time for reduced slippage on your trades.

We execute all orders through a single tag, meaning LPs see one client - Flexiblefxtrade. Liquidity providers cannot reject your trades because you’re too sharp or reverse engineer your proprietary trading system.

Flexiblefxtrade entered a strategic joint venture with Institutional ECN provider ‘TraderTools’ in 2020 and now offers this as a standalone product to its institutional clients.

Flexiblefxtrade aggregates liquidity from tier-1 banks, non-bank market makers and (institutional) ECNs.

We trade with, and not against you. But what does this even mean?

Flexiblefxtrade | Market Maker | |

|---|---|---|

| No conflict of interest between you making money and broker profitability? |  |  |

| Wants clients to trade profitably? |  |  |

| Does not make money from your losses? |  |  |

| Does not make hedge execution decisions based on client trading behaviour or account profitability? |  |  |

| Does not benefit from wider spreads causing stop out of retail traders. |  |  |

| Does not benefit from interbank stop hunting. |  |  |

Our cutting edge ECN technology enables us to leverage 10 years of trading relationships to provide clients anonymous access to a unique and diverse pool of liquidity.

This means that you can rest assured that we have built the ultimate trading environment that couples industry leading technology with years of trading experience which has culminated in Flexiblefxtrade being recognised as the 'traders brokerage'.

An exclusively ECN broker is beneficial as it means that you can focus on your trading and not your broker. In an industry that is full of brokers whose models are predicated on profiting from clients losses, our true ECN model stands in stark contrast to these practices by providing for accountability, transparency and honesty including post trade transparency.

There is no conflict of interest between Flexiblefxtrade and our clients. Why? Because we do not profit from clients losses. Our goal is to serve the clients needs before our own by delivering the best product to our clients. On the contrary, when you win, we win.

Unequivocally, No.

No, your personal identity is completely anonymous to our LP’s.

STP = straight through processing, which means that your trades are executed automatically by way of our ECN with no manual intervention.

NDD = No dealing desk which refers to a broker that does not market make rather, by way of our ECN we provide clients access to our network of LP’s, enabling every trade to be taken to the real market.

Commission FreeOur new lowest fee model. Trade EURUSD from 0.4 pips round turn with no added commissions Apply Now | Spreads + CommissionTraditional ECN fee model with spreads from 0.0 pips and $7/lot commission. Apply Now | |

|---|---|---|

| Spread From | 0.4 Pips | 0.0 Pips |

| Commission | $0 | $7 per round turn lot |

| Starting Deposit | $200 | $200 |

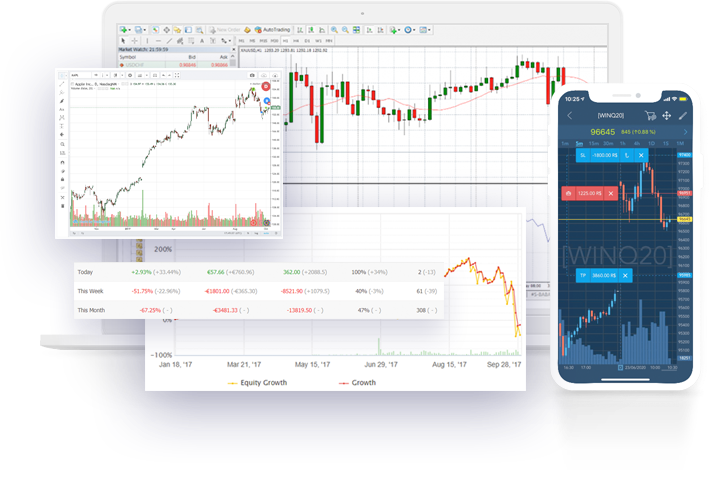

| Platforms | MT4, TraderEvolution, TradingView | MT4, TraderEvolution, TradingView |

| Server Location | New York | New York |

| Execution speeds from | 1ms | 1ms |

| Micro lot trading(0.01) |  |  |

| 100+ Markets | 100+ Markets FX, Indices, Commodities, Digital Currencies, Shares, Bonds | 100+ Markets FX, Indices, Commodities, Digital Currencies, Shares, Bonds |

| One Click Trading |  |  |

| Trading Styles Allowed | All | All |

| Order Distance Restriction | None | None |

| Suitable For | All Traders | All Traders |

Make managing your trades faster, easier and more convenient.

Wherever you are.

Spreads From

Execution From

Trade Markets

Deposit & Withdrawal

Fund your account with over 15+ instant deposit methods. AUD, EUR, GBP, JPY, SGD or USD - save on conversions!

Trade directly from charts using your TraderEvolution account - easy!